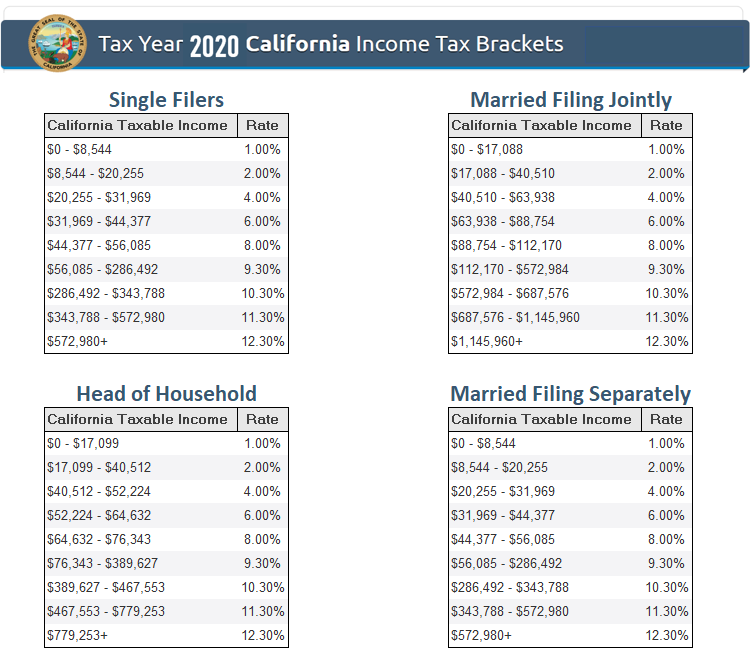

Tax Year 2025 California Income Tax Brackets. California has a progressive state income tax system with rates ranging from 1% to 13.3% for the 2025 tax year. The below state tax rates and brackets from the california franchise tax board (ftb) apply to income you earned in 2025 (reported on your 2025 tax return).

We will know them by the end of 2025. This rate includes a 1% mental health services tax applicable on income in excess of $1 million per year and a 1.1% payroll tax from which an income ceiling was removed.

When Are Estimated Taxes Due 2025 California 2025 Flor Annemarie, Note, the list of things not included, such as deductions, credits, deferred income, and.

California State Tax Brackets 2025 Calculator Micki Francisca, Calculate/estimate your annual federal tax and california tax commitments with the california tax calculator with full deductions and allowances for 2025 and previous tax years

California Tax Brackets 2025 Married Jointly Bunni Coralyn, As a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2025 tax year.

Tax Brackets 2025 Federal Irene Leoline, The tax information provided here is based on 2025 federal marginal rates and state tax rates.

20242025 New Federal Tax Brackets A Comprehensive Guide, Application for authority (for foreign llcs):

Tax Brackets 2025 Calculator Uk Dorris Nadiya, There is also a 0.9% state disability insurance payroll tax for.

California Tax Brackets 2025 Merle Kattie, Related items for tax year 2025 (those adjustments are.

California Tax Brackets 202425 202425 Calculator Rici Verena, This rate includes a 1% mental health services tax applicable on income in excess of $1 million per year and a 1.1% payroll tax from which an income ceiling was removed.